Using Cricut Design Space and a cute teacher appreciation printable, we assembled and easy craft and teacher gift idea. Download this 3-D Paper Cactus Template gift this mini potted cactus to your fantastic teacher – “Thank you for being a fan-cactus teacher!”

Fan-cactus Teacher Printable Gift Tag

3-D Paper Cactus Template

Sometimes classroom and indoor spaces lack the sunlight for a small potted plant. We put together this easy to make Mini Potted Cricut Paper Cactus. Follow this step by step tutorial in design space and wirelessly cut with Cricut Explore or Cricut Maker machines. After creating an adorable mini paper plant, we provide an optional teacher appreciation gift tag to thank a “fan-cactus” teacher!

Let’s get started!

Cactus Craft Materials

The following materials are needed to create your 3d cactus craft.

- Torch Cactus template in Cricut Design Space (#M103661F)

- Cricut Maker (or Cricut Joy) with Fine Point Blade and Scoring tool

- Cricut Light Grip Adhesive Cutting Mat

- Cardstock paper in light green, dark green, coral pink and cream colors

- Mini terracotta pot (we used 2”)

- Cricut Spatula

- Smoothfoam Styrofoam Ball (we used 1.9″)

- Hot glue gun with clear hot glue sticks

- Glue stick

- Optional: Mini Landscape Rocks

DIY Cactus Instructions

First gather your supplies. You will begin your process in Cricut Design Space, craft your DIY cacti, and then create your final potted paper cactus plant. When your craft is done, you can print our cactus teacher thank you note and tie with a ribbon.

3D Cactus SVG on Cricut Design Space

Open Cricut Design Space.

Click on the “+” sign to start a new project and open up a blank canvas.

Click on the Images button from the toolbar.

Search “torch cactus” image (#M103661F). Click the image to insert the pattern on the design canvas.

Resize grouping to double the original height to 4.5 inches high.

Click on the shape button on the toolbar to insert a circle shape.

Measure the diameter of your terracotta pot and resize the circle shape to match slightly smaller than the diameter of the top of the terracotta pot. (In this case, the circle shape is sized to 2.125”.)

Change the color of the lightest green pieces to pink and change the color of the circle shape to cream color. Move to the color sync tab to see all the pieces sorted by color.

Cutting Paper Cactus Template

With the machine set to Cricut Maker, select “Make It” in Design Space.

Set the material type to Cardstock, choosing the appropriate weight based on your paper.

Place your first paper color onto the light grip mat.

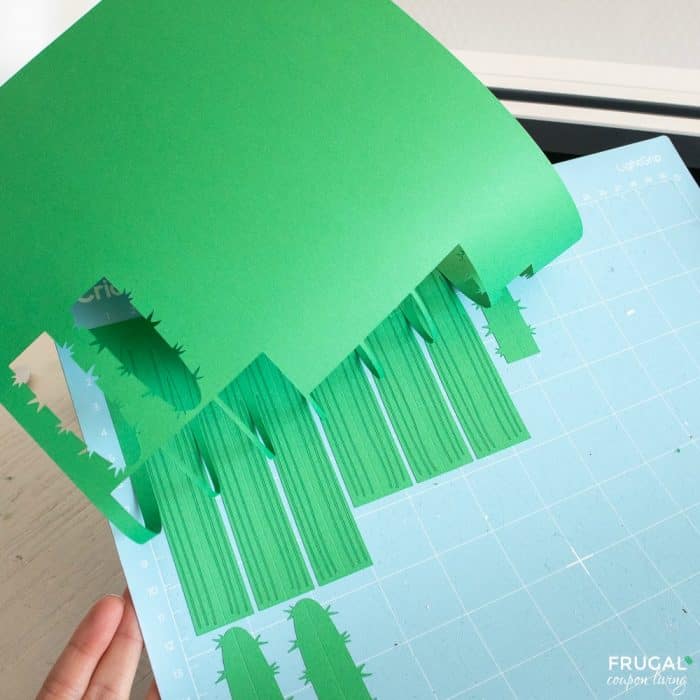

Follow prompts for loading cardstock paper into Cricut Maker and cutting. When the cut is complete, unload the mat from the machine.

Remove the cut pieces from the cutting mat using a spatula tool.

Repeat for the remaining colored paper cactus pieces and circle base.

Assembling the Paper Cactus Plant

Create a sharp fold on the cactus pieces along the score lines.

Group the similar sized pieces together to create a total of three separate cacti.

Start with the largest sized cactus pieces. Using a glue stick, glue the pieces together, sandwiching the prickly pieces between the other colors, alternating them as you go along.

Press the paper cactus sides together firmly.

Repeat with the smaller and medium sized cactus.

Allow your glued paper cactus plants to dry.

Assembling the 3D Potted Paper Cactus

First, place a dot of hot glue at the center bottom of your terracotta pot.

Lay the styrofoam ball inside the terracotta pot and let it settle on the glue dot.

Next, place a glue dot on top of the ball.

Cover the ball with the cream colored circle shape.

Lastly, attach the prepared 3-D cactus paper plants on top of the circle with hot glue and hold in place until glue sets.

Allow your final piece to dry.

Optional: Using a hot glue gun, on the flat surface of your potted plant, glue down sand and rocks.

Teacher Appreciation Printable

Using an adorable ribbon (we love this green gingham check ribbon), tie off our cactus teacher thank you note a back to school, teacher appreciation week, or end of the year teacher gift idea.

Teacher Cactus Quotes

We pulled together some punny teacher cactus quotes to use this cactus craft as a gift.

Bloom where you are planted.

Let’s stick together.

Needle’s to say you’re a great teacher!

Thank you for helping me stay sharp.

Teacher, you are always on point!

You can hand write your note (see our hand lettering ideas) using the quotes we provided or print off our teacher printable below.

“Thank you for being a fan-cactus teacher” Printable Gift Tag Instant Download

By downloading you are accepting the terms that this is for personal, non-commercial use. Please contact Frugal Coupon Living with any questions.

I am happy to share printables. When sharing with others, please lead them to my website instead of emailing them the file(s). Thanks for visiting and thanks for sharing with others!

Teacher Appreciation Gift Tags

Before you go on, take a look at this! Solve an entire year of gifts with this Teacher Appreciation Gift Tags set. Included in this set are 12 months of gift tags. Each gift tag can be paired with a small low-cost gift just to show an appreciation of thanks.

Our Cactus Teacher Appreciation Gift Tags are included in this set. From plants to chocolate bars, these Teacher Appreciation Gift Ideas can be used the entire school year!

How to Teacher Appreciation Printable at Staples

I have a video to show you how I print my PDF documents at Staples. First, sign in or create a Staples account. Using the Staples printing service page, you can ship your teacher thank you note printable or pick it up.

Our Pinterest community and I would love to see how this worked out for you. Share your final 3-d Cricut Cactus and Teacher Appreciation Cactus Printable . Leave a comment and/or add a photo here on Pinterest!

Follow these Cricut Freebies & Tutorials. Pin to Pinterest.

Also save these Teacher Appreciation Printables to use throughout the year. Pin to Pinterest.

WHAT’S TRENDING? Looking for a few engaging activities? Grab Minute to Win it Games – Traditional, Holiday, Group, and more! Use these fun activities in the office, classroom, or at your next birthday party.